The global shipping industry is facing a new problem: once

2022-11-23

2022-11-23

349

349

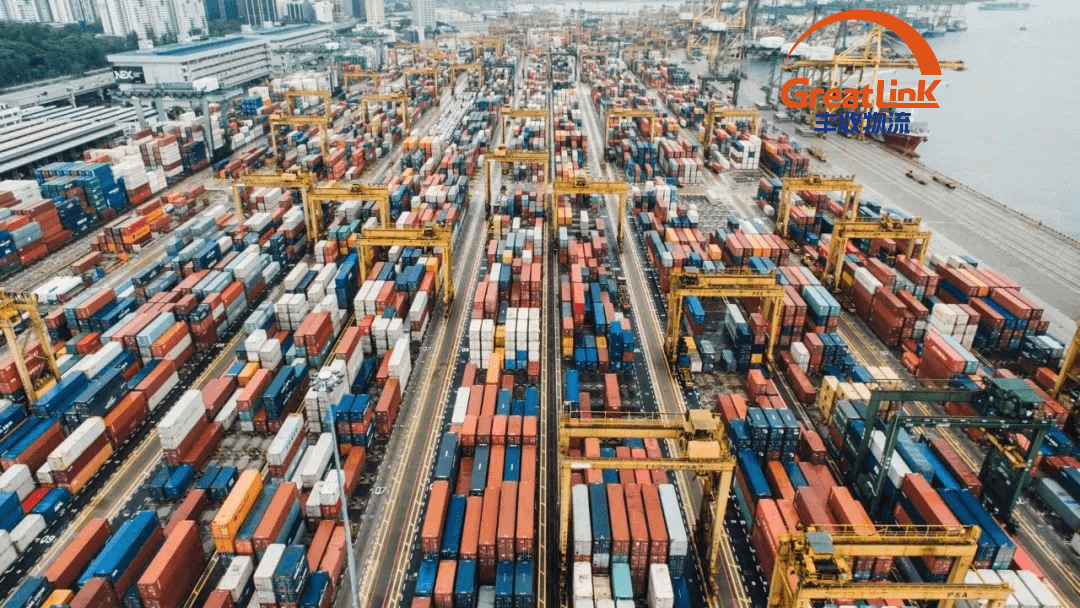

It is reported that the global Container shipping industry is facing a completely opposite problem to the previous "one box is hard to find": emptyBoxIt's too much to fit.The economic slowdown and excess inventory have led to a decline in demand, leading toPort emptyContainer has a backlog, and the warehouse space is not enough to accommodate all these Container.

According to the report of Container xChange, a leasing trading platform in Container, the order-to-inventory ratio of industries with high inventory and slow demand has dropped sharply, which has a chain reaction to different stages of logistics in Container.One of the most prominent problems is the lack of warehouse space, which will have a significant impact on Container's repositioning and transportation in 2023.

"There is not enough warehouse space for all Container," said Christian Roeloff, co-founder and CEO of Container xChange.As Container inventory is further released into the market, warehouses will face greater pressure in the coming months. One key is a challenge for some businesses and a competitive advantage for others, especially in China, where empty boxes are being repositioned. "

Andrea Monti, chief executive of Sogese, which has Container warehouses in multiple European locations, told the Digital Container Summit in October: "Our warehouse in Milano is very crowded, ContainerQuantity is increasing, so we are returning someWarehouse. Request service agreement. We are now in a situation where warehouses in certain locations cannot accept new customer requests. "

With Christmas approaching, retailers are wary of high inventory in their hands. "Technically, there will be no peak season for freight this year".

"Retailers have enough inventory," Monty said."Once the inventory in North America and Europe is used up, the order will be placed again, and the demand for production capacity will pick up. It will not return to the peak level during the epidemic, but it will definitely return to the long-term average level." "It is on the rise.What is happening now is that goods are delivered'on time 'again, so we will see a slowdown in new orders as businesses adapt to more efficient shipping turnaround times. "

Darin Miller, national maritime manager of Sedgwick, a global claims management provider, said that in order to solve the problem of warehouse overflow, ports such as Houston Port have begun to implement parkingAt the dock for more than 7 daysContainer charges.

"Too many on ships or portsContainer, usually parked for weeks at a time, and the lack of warehouse space will only aggravate the ongoing supply chain crisis because it will affectContainerThe repositioning and movement of. "

Johannes Schlingmeier, co-founder and CEO of Container xChange, said: "For Container owners, as more and moreContainerStacked up, which could mean higher Container storage costs for warehouses. "

According to the latest Drewry report, due to the record high of the new Container Quantity delivered in 2021, it is currently estimated that there are more than 6 million TEUsContainer ont >Excess. At that time, Container produced more than 7 million TEUs, and lessors and shipping lines also avoided eliminating the old Container due to congestion.

"Aging Container is now being sold to the second-hand market at a much faster rate as shipping companies address excess capacity based on existing and short-term demand and shipping capacity forecasts.Contracts for returning equipment to Quantity have increased significantly.This will continue until 2023. "

According to the latest monthly logistics report of Container xChange, Chinese standard ContainerAverage transaction price and one-way rental costHas fallen to its lowest level in two years.The price was $3,711 in October and fell further in November (so far).

The CAx (Container Availability Index) value is much higher than before the epidemic, which means that compared with 2019 and beyond, this year's Chinese ports entering Container and Quantity are significantly higher than leaving ContainerQuantity.

Since May 2022, the standard Container one-way charter fee from Chinese to North America has dropped month by month, from $1,773 in October to $344.The one-way rent from China to Europe dropped from $2,845 in January this year to $1,726 in May, and further dropped to $910 in October.

Roeloffs added: "The decline in freight rates and prices in Container shows weak demand in Container and surplus in Container. The bigger the gap, the lower the freight rates and prices in Container will be. With the peak season this year, logistics companies have begun to prepare for the New Year.

ContainerThe imbalance between supply and demand has intensifiedThe increase of empty containers shipped to Asia and the increasing shortage of warehouse storage space will be the topic of concern in 2023.

Great LinkIn airliftAndSea transportationHave a great price advantage in all aspectsWe serve 5, 000 companies around the world.No matter in the peak season or off-season, we can guarantee the shipping space supply and quality service.For more quotations, pleaseClickOur representativesFind out more.